¿En qué consiste la oportunidad de inversión?

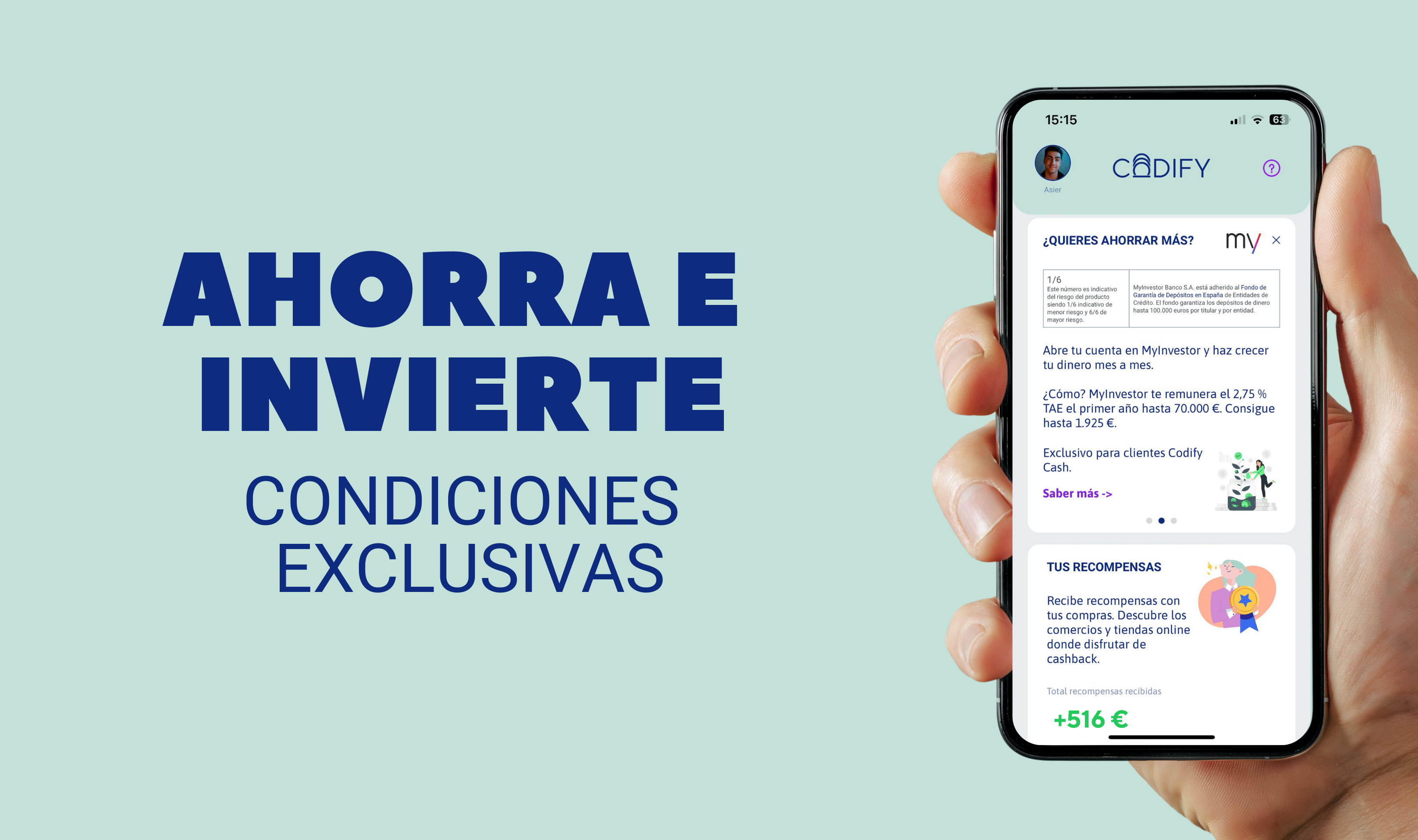

Codify Cash is a digital piggy bank, a financial tool that allows users to save money safely, easily, and online.

It works as a digital savings piggy bank in a mobile application, where users can set savings goals, schedule deposits, and round up purchases to deposit the spare change into the piggy bank. This facilitates constant and effortless saving, helping users reach their financial goals efficiently and in an organized manner. It also offers investment options in various financial products with different risk levels according to the user's profile, allowing them to multiply the savings generated.

Codify Cash is an innovative financial tool that combines multiple functionalities in a single mobile application, designed to facilitate user savings and financial management. This tool not only allows users to save money automatically and systematically, but it also integrates a payment method to make purchases, generate savings through cashback, and multiply savings with financial products.

Codify Cash Modules

- Integrated Payment Method: Codify Cash includes a virtual debit card that users can use to make purchases online and in physical stores. This payment method is directly linked to the digital piggy bank account, allowing for detailed and real-time tracking of all transactions. Additionally, by using this payment method, users can activate automatic saving functions, such as purchase rounding, where the spare change from each transaction is deposited into the digital piggy bank.

- Savings Generation through Cashback: Every time users make a purchase with the linked card, they receive a percentage of the money spent back, which is deposited directly into their digital piggy bank. This rewards system not only encourages the use of the integrated payment method but also helps users accumulate savings without additional effort. Partnerships with a wide network of stores and brands allow maximizing the benefits of cashback.

- Savings Multiplication with Financial Products: Codify Cash offers options to invest the saved money in various financial products. Users can choose to invest in mutual funds, high-yield savings accounts, bonds, or even in micro-investment products that allow them to diversify their portfolio with small amounts of money. These investment options are designed to help users multiply their savings and achieve their medium- and long-term financial goals directly through our partner platform (Myinvestor in this case). Codify provides a channel as an educational and financial advisory tool to explain each of the products to users and serve as a guide in their investment decisions.

The rounding tool will be included so that those who want to set a savings goal can configure the rounding they want to assign to their piggy bank for each purchase.

STAGE INVERSIÓN

MERCADO

- personal-finance

- insurance

WEB OFICIAL

Incentivos fiscales

Equipo de Codify

CEO

CEO

Josean Borge

CEO

Emprendedor por naturaleza/vocación y Politologo por formación

Álex Lobo

COO

Asier López

Head of Marketing

Rubén Cañizares

CFO

Xabier Pena

CTO

Javier Sorribas

Service Desk Manager

Almudena Garcia Atance

BUSINESSANGEL

Bee my Business Angel

BUSINESSANGEL

Juan Carlos Milena

USER

BIC Bizkaia Ezkerraldea

ACCELERATOR

Climbspot

INCUBATOR

Motivos para invertir Ver más datos

Investing in Codify Cash is a strategic and lucrative decision for several reasons:

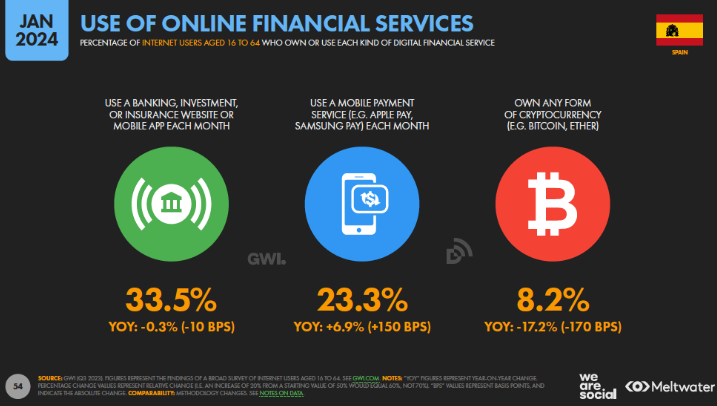

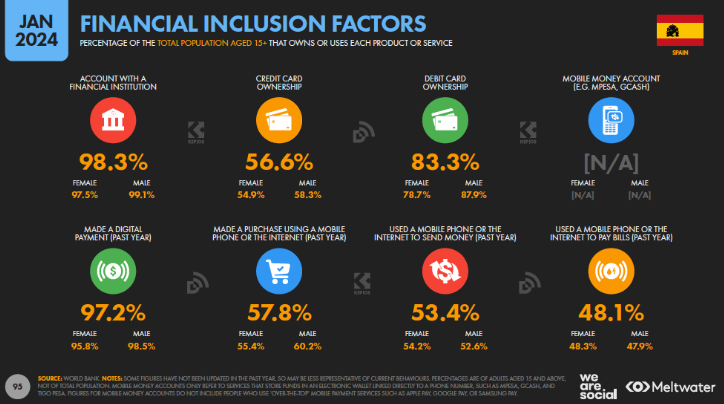

Growth of the FinTech market: The FinTech industry (payments) is experiencing significant growth (33.5% according to the 2024 report from We are social and Meltwater), driven by digitalization and the increased use of mobile devices. Investing in an app that combines cashback, savings, and financial products positions investors in a dynamic and expanding sector. In 2024, the transaction value of the FinTech sector is expected to exceed 80,000 M (encompassing digital payments, personal finance, loans, etc.). Download documentation.

Example of transaction amounts (Euros loaded on Codify cards and spent by users):

- June (Launch month): €505

- July (first full month of service): €17,477

- August: €28,354

Scalable business model: The possibilities of our App are endless. We started with an initial offering of three products as a hook to create a user database and are increasing the offer through phone surveys to meet demands based on the consumption behavior of our active users. Currently, we are integrating rounding for the digital piggy bank and the Crypto Broker after the July survey. Before the end of the year, we will include Open Banking for payment initiation from the user's primary bank.

Attractive to consumers: Consumers are increasingly interested in solutions that help them manage their finances efficiently. An app that offers cashback provides an immediate incentive, while a digital piggy bank and financial products promote long-term savings and investment. This combination creates an attractive value proposition for a wide range of users, especially among young people aged 18 to 35, who represent more than 10 million people. We are also seeing a significant number of registrations from people over 50 on our own platform, who are looking for other types of solutions to manage a small part of their income in fee-free accounts, distancing themselves from the traditional bank spectrum. This growth is due to the fact that apps like Codify are seen as “smarter” by users than the banks themselves.

Customer loyalty: Offering multiple financial services on a single platform increases customer retention. Users who find value in cashback while also saving and investing through the same app tend to be more loyal and less likely to switch to competitors.

71% of Millennials are currently seeking help to manage their money.

Diversified monetization: Codify Cash has multiple revenue streams. Revenues can be generated through transaction fees, affiliate agreements with stores and brands like Cashback, and fees on financial products like the one already signed with Myinvestor. Also, through commissions from the Crypto Broker. This diversification reduces financial risk and increases profit opportunities.

Innovation and differentiation in the market: The combination of these three services in a single app allows the company to differentiate itself in a saturated financial app market. Innovation in offering integrated services not only attracts new users but also positions the company at the forefront of technological and consumer trends, enhancing its competitive position.

The Codify App currently provides direct access to more than 500 online and offline stores, including the most relevant brands in hospitality, sports retail, furniture, pets, etc.

¿Quién es el inversor de referencia?

Almudena Garcia Atance

BUSINESSANGEL

Sobre Almudena Garcia Atance

Almudena es una persona entusiasta y emprendedora. Fue la primera inversora de Codify en su creación aportando 225K y acompaña de nuevo en esta ampliación con 30K + 30K. Apoya parte de numerosos proyectos como promotora e inversora, siempre en proyectos relacionados con impacto social, medioambiente y creación de valor. Aunque, si bien tiene un portfolio amplio de inversiones, estas se caracterizan por ser discreto a nivel medio y exposición pública.- Investing in startups:Confidential

- Invested Euros:>2M

- Investments:Confidential

- Exits:Confidential

The main reason for investing in Codify was the concept of "Savings" and the contribution our model provides to people who are always looking to "save" on their purchases or at least "generate" cashback to build a savings pot, regardless of how they choose to use it. The focus wasn't on the short term, but on the medium to long term, where a platform like Codify makes perfect sense given the market trends in the consumption of financial products or cashback.

También ha invertido en...

Directo

Chat

Necesitas estar registrado para ver el contenido

Este contenido es confidencial y es necesario que estés registrado en Startupxplore para poder acceder.

RegistrarmeAnálisis oportunidad Última actualización 29-ene-2026 16:08:16

Necesitas estar registrado para ver el contenido

Este contenido es confidencial y es necesario que estés registrado en Startupxplore para poder acceder.

RegistrarmeEsta oportunidad de inversión ya está cerrada.

Documentación

Necesitas estar registrado para ver el contenido

Este contenido es confidencial y es necesario que estés registrado en Startupxplore para poder acceder.

Registrarme