Index

- What is Startupxplore?

- Types of companies to invest

- What distinguishes the companies we are looking for?

- How have our investment criteria been designed?

- Startupxplore investment criteria

- Enterprise-related criteria

- Criteria related to the sector of activity

- Criteria related to the co-investment model

- Criteria related to the investment transaction

- Criteria related to financial aspects

- Criteria related to the team

- Criteria related to legal and ethical aspects

- Criteria related to the shareholders agreement

What is Startupxplore?

In Startupxplore we are investors, and through our online platform we offer investment opportunities in companies with high potential, in which we invest together with other professional investors . All investors registered in Startupxplore have access to the investment rounds of these companies, in which they can invest under the same conditions as the other co-investors, and benefit from their experience and knowledge.

The main objective of Startupxplore is to invest in innovative companies creating a well-balanced and diversified portfolio, and to share with its users the entrance to those companies with high growth potential, in an easy and safe way. It is an investment platform where quality comes before quantity .

Startupxplore is also the largest community of startups in Spain and one of the most active in Europe, becoming in a short time the main resource to find the best investment opportunities.

Types of companies to invest in

At Startupxplore we believe that innovative companies, lightweight in structure but with high potential, are the basics of economic changes, and that is why we have not only created an investment platform through which they can be financed, but we also actively invest in them and help them to make that change a reality.

Seed Stage

companies that are developing their concept and creating a minimum viable product (commonly known as MVP) to validate in the market.

Seed

- Ticket size +50.000 €

- Pre-money valuation < 1.800.000 €

- Competence No

- Company age None

Early stage

Companies that are testing their product and have metrics with which they can iterate, incorporate user feedback and improve their recruitment strategy.

Early

- Ticket size +150.000€

- Pre-money valuation < 8.000.000 €

- Competence Yes

- Co. age 6 months B2C/9 months B2B

Scale-up stage

Companies with a proven business model, an average annual turnover growth of more than 20% over three years, and 10 or more employees.

Scale-up

- Ticket size +250.000€

- Pre-money valuation > 8.000.000 €

- Competence Yes

- Company age 1yo B2C / 1,5yo B2B

What distinguishes the companies we are looking for?

- Demonstrate high growth capacity

- Have scalable business models.

- Are in stages prior to consolidation.

- Are efficient in the use of capital.

- Focus on creating highly scalable but solid businesses.

- Generate real value for their customers.

- Understand investment as a way of financing early-stage growth.

How our Investment Criteria have been designed?

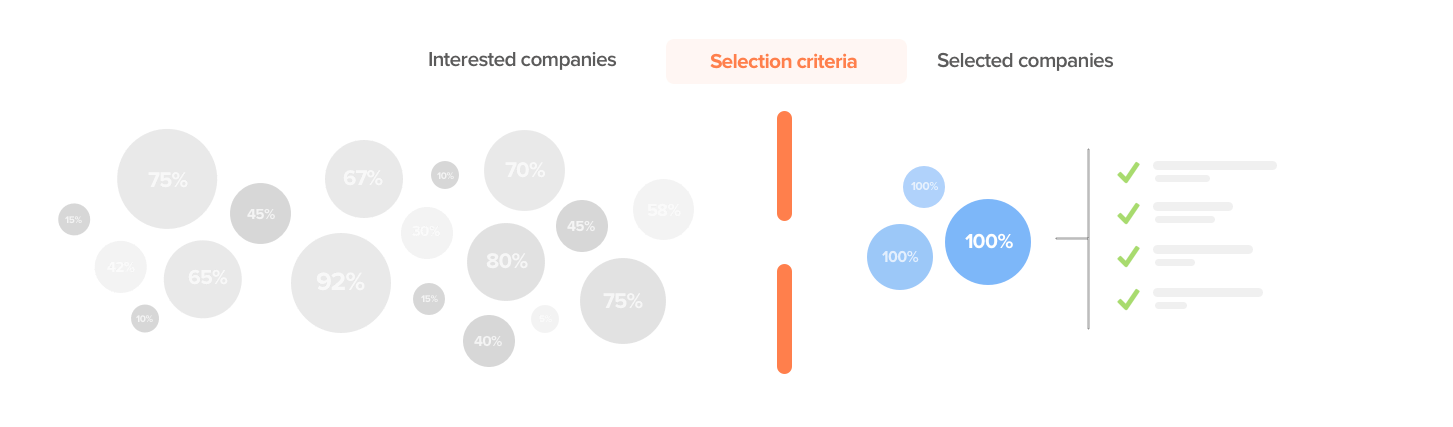

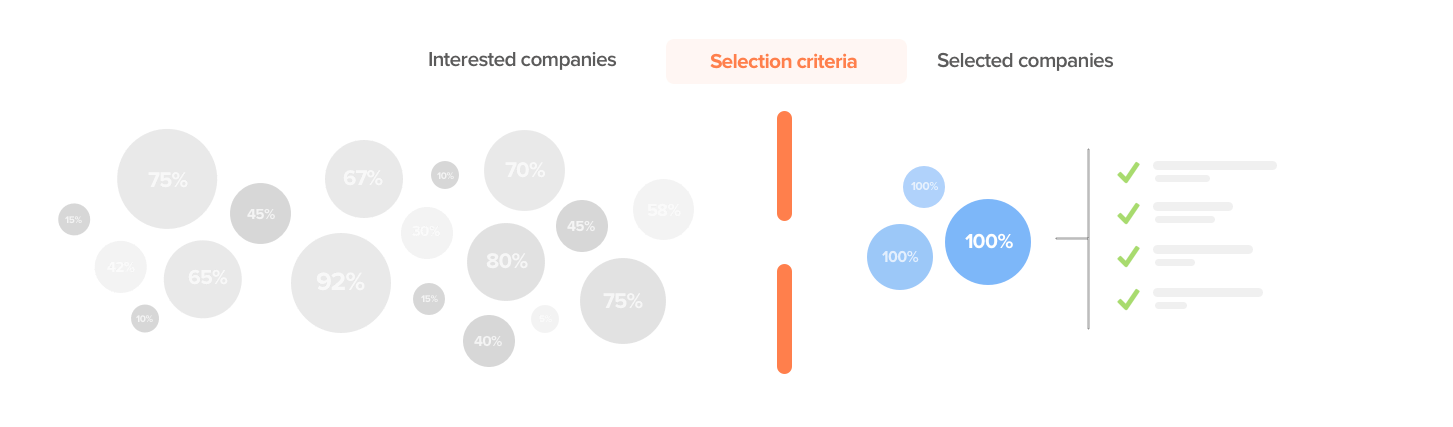

Our investment platform is not a marketplace, that is, we do not act as a mere connector between investors and project promoters; rather, we filter and analyse the companies that come into our hands, and publish and invest only in those that exceed our criteria and analysis.

We believe that it is virtually impossible to identify which companies will succeed a priori, but that it is feasible to identify risk factors that can cause a company to fail early.

That is why we have designed, together with the main startup investors of the national panorama (and a good part from abroad), some filtering criteria based on their knowledge and experience, which help us to discard companies with an excessive risk level.

That is why we have decided to focus on:

- Investing in LESS companies but of BETTER quality.

- Increasing the possibility of success by being very thorough in companies’ analysis and risk mitigation.

- Not attempting to maximize the probability of success at the cost of taking more risk.

- Investing our own capital in all operations we launch.

- Thinking long term and building an investment portfolio with a diversified and premium focus.

At a market where more and more money is devoted to investing in innovative companies with high growth potential, more companies looking for capital and more tools to participate in its shareholding, we believe that it is more important than ever to be consequent with our principles and therefore be transparent sharing our investment criteria.

Startupxplore's Investment Criteria

We invest in innovative companies that are in different phases (seed and early), with different characteristics, different levels of risk, and obviously different assessments.

That is why we have created several company profiles according to the stage they are in and, consequently, different analysis criteria for each of them.

To present a transaction to Startupxplore investors, the company must meet all the criteria of the phase in which it is , which we verify after a process of analysis from different angles in which we contrast the information provided by it.

1 Criteria related to the company

In Startupxplore we believe that the best companies can be born anywhere, from a large city to a small town away from large population epicenters. Even so, we believe that, depending on the phase in which we find ourselves, the following criteria must be met:

| Criteria |

Seed |

Early |

Scale-up |

| Registered office |

European Union |

European Union |

European Union |

| Minimum "age" in B2C businesses |

- |

6 months |

1 year |

| Minimum "age" in B2B businesses |

- |

9 months |

1.5 years |

| Should there be competition? |

- |

Yes |

Yes |

| Product on the market? |

>=TRL3 |

>=TRL7 |

>=TRL8 |

*TRL : The TRLs defined by NASA are currently used internationally in the industrial sector to delimit the degree of maturity of a technology.

- TRL 1 - Basic principles studied

- TRL 2 - Formulated technological concept

- TRL 3 - Experimental proof of concept

- TRL 4 - Laboratory Validated Technology

- TRL 5 - Technology validated in a relevant environment (industrial relevant environment in the case of key enabling technologies - KET-)

- TRL 6 - Technology demonstrated in a relevant environment (industrial relevant environment in the case of key enabling technologies - KET-)

- TRL 7 - Prototype demonstration in operational environment

- TRL 8 - Complete and qualified system

- TRL 9 - Real system tested in an operational environment (competitive manufacturing in the case of key enabling technologies -KET- or in space)

2Criteria related to the sector of activity

At Startupxplore we are agnostic about the sectors in which to invest, we have no preference for them and we believe that this is the basis for good diversification. We apply a logical criteria with regard to the sectors that we automatically rule out:

- Pornography

- Human clonation

- Tobacco

- Prostitution

- Gambling

- Homeopathy

3Criteria related to the co-investment model

One of the key aspects that differentiates us is the co-investment , since absolutely all the operations we propose must have the figure of one or several investors who have decided through their own analysis process to invest in the company , often business angels or venture capital funds with proven experience, which commit a relevant part of the invested capital.

This implies that, in addition to all the risk analyses and requirements imposed by Startupxplore, there must be an independent and external third party that not only considers the company to be a good investment, but also invests under the same conditions as Startupxplore investors and assumes a relevant part of the round, which benefits and aligns the interests of all investors.

- There must be a pre-committed reference investor at the time of launching the round with Startupxplore.

- This one accepts to lead the operation in Startupxplore, and knows and accepts the syndication format

- It invests exactly under the same conditions as Startupxplore (there is no transfer of shares, private agreements, neither previous or subsequent payments between the company and him).

- Invest at least 10-15% of the round in Startupxplore.

- He/She has experience investing in innovative companies with high growth potential (at least 5 previous investments).

What amount must these pre-committed tickets reach?

| Criteria |

Seed |

Early |

Scale-up |

| Coinvestors |

>=30% |

>=30% |

>=30% |

4Criteria related to the investment transaction

The idea is to have a diversified portfolio, both in terms of sectors and in terms of the phases in which our investees find themselves in. That is why the criteria related to the investment operation that companies must meet in order to be invested are:

| Criteria |

Seed |

Early |

Scale-up |

| Pre-money valuation |

<1.8M |

<8M |

>8M |

| Ticket size via Startupxplore |

>50k |

>150k |

>250K |

| Runway pre-round |

- |

3 months |

3 months |

| Runway post-round |

6 months |

6 months |

6 months |

5Criteria related to financial aspects

We want to invest in companies that are well managed financially, efficient in the use of capital and that focus on creating solid businesses that generate real value for their clients, with a vocation to become profitable companies.

| Criteria |

Seed |

Early |

Scale-up |

| Generating revenue? |

- |

At least 3 months |

6 months |

| Destination of the round to debt payment (max) |

10% |

20% |

20% |

6Criteria related to the team

In Startupxplore we believe that the basis for the success of any project is a good team, and therefore one of the aspects to which we pay more attention is how it is designed, its incentives, how it is managed and its structure.

| Criteria |

Seed |

Early |

Scale-up |

| Full dedication (min.) |

66% |

80% |

80% |

| Technical profile (min.) |

1 |

1 |

1 |

| Marketing / Sales / Business profile (min.) |

1 |

1 |

1 |

| % min of shares in founders hands |

50% |

30% |

20% |

| Salary * |

<x25 |

<x25 |

<x25 |

The average gross annual salary of the annual founding team x25 must be LESS than the company's current pre-money value.

7Criteria related to legal and ethical aspects

One of the values that defines us as a company, both the team that directs it and all its partners, is a great concern for business ethics and strict compliance with the obligations contracted, so one of the key aspects that we will analyze in all our investments is compliance with legal and administrative obligations.

- The brands used by the company to perform its activity are registered at least in its origin country.

- The company is aware of its obligations with the Public Treasury and Social Security.

- The domains from which the activity is exercised are in the name of the company.

- The company has not had any serious and / or very serious judicial and/or administrative sanction.

- Neither the company nor its founders are involved in any type of insolvency sanction.

8Criteria related to the shareholders agreement

In addition, for an investment transaction to be successful, it must be regulated by a shareholders agreement that includes a series of minimum clauses:

- Drag along

- Tag along .

- Duty of information on a quarterly basis.

- Salary of the founders requires approval from investors.

- There is a possibility of veto before a proposed change of activity.

- The founders with 100% executive dedication have an agreed permanence of minimum 2 years (Vesting).

- The founders have an obligation of exclusivity with the company of at least 80% of their time once the capital increase has been carried out.