Diversification and the probability of independent events: advantages of diversification

Category: Understanding startup investment

diversificationindependent eventsstartups investmentwell-diversified investment portfolio

Hereunder we would like to explain why it is so important and strongly recommend from Startupxplore to have a well-diversified investment portfolio. Although we are sometimes totally convinced that we are investing in a “winning horse”, the odds of a company failing in its beginnings are high, so it is best to reduce that risk. How can we do that? DIVERSIFYING!

WHAT IS DIVERSIFICATION?

It’s something really easy to understand, it’s about putting the “eggs” (money) in different “baskets” (startups) and not in a single one (startup), because if we have all the eggs in one basket, what would happen to them if we drop it?

In addition to popular knowledge, there is a statistical theorem (don’t be scared!) that many of us have probably heard about and even studied at school or university and that explains in a simple way why diversify. Let’s go to it, and remember, you can raise your hand whenever you want to ask ;)

THE PROBABILITY OF INDEPENDENT STARTUPS (EVENTS)

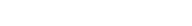

Imagine that we have a basket full of startups (the market) in which we can invest and we decide to take one and invest in it, and it goes through our minds… what is the probability that the startup I have chosen will end up failing after 3 years? Well, let’s assume for now that this probability, on average, is 90%, i. e. as a percentage, 90% of companies end up failing after 3 years of life.

Now, aware that it is important to diversify, we decided to invest in another one, and we ask ourselves again, what is the probability that the second startup I have chosen will end up failing after 3 years? Since the “basket” of startups is always filling up (the creation of new opportunities is constant and even exponential), we will say that it is the same as the failure of the first one we have chosen, 90%.

And now, hold on to yourself, here comes the big question, what is the probability that the two startups will fail after 3 years? Let’s see, since we are talking about startups that are “totally independent” (the probability of failure of one startups does not affect the probability of failure of the other one), and continuing with the “theorem of independent events probabilities“, it will be calculated as follows:

P(failure S1 AND S2) = P(failure S1)*P(failure S2)

P(failure S1 AND S2) = 90%*90% = 81%

Therefore, the probability that the two startups will fail after 3 years and therefore lose my capital is 81%, less than if we invest all our capital in a single startup, 90%.

Now, imagine that we decided to invest in 5 startups, what is the probability that the 5 startups will fail after 3 years?

P(failure S1 AND S2 AND S3 AND S4 AND S5) = 90%*90%*90%*90%*90% = 59,1%

Therefore, the probability of failure of the 5 startups after 3 years is 59.1%, considerably lower than if we invest all our capital in one, two, three and even 4 startups.This means that…

The greater the number of startups in our investment portfolio, the less risk we have of them all failing and therefore, the greater the likelihood of success we will be able to achieve.

It should be noted that, in addition to the number of startups, diversification is recommended based on:

- Geographical areas

- Areas of activity

- Type of products

- “Vintage”

… because every % (probability of failure) is different and therefore directly affects our chances of success. This is why we always recommend you to invest in several startups instead of concentrating your entire investment on one or two.

HOW CAN YOU DIVERSIFY WITH STARTUPXPLORE?

Using Startupxplore it’s easy to diversify, because instead of having to commit a minimum ticket of between 30,000€ and 50,000€ per deal, you can start investing from much less.

In addition, in Startupxplore we make a varied selection of operations following criteria of diversification in markets, locations, products and of course vintages. Therefore, instead of making a very strong bet on a few companies, it is better to commit a smaller amount but in many operations.